Capital

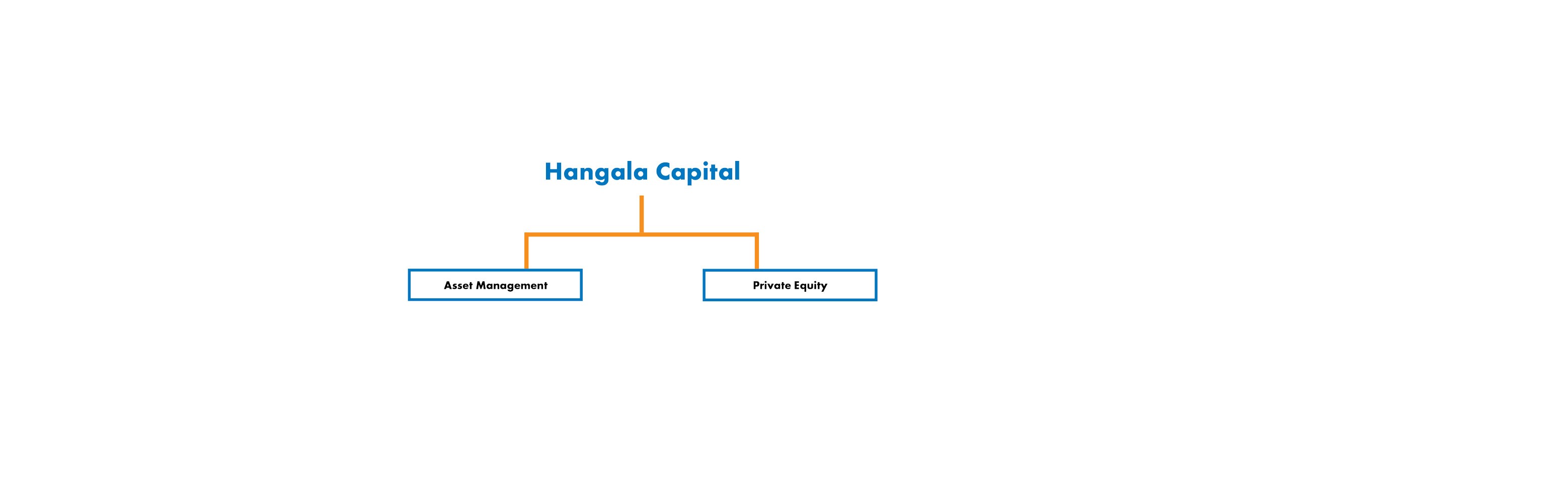

Hangala Capital teamed up with Nineteen Nil Four Holdings, Trophy Shapange, and a South African partner, Aluwani Capital Partners (Aluwani), through Hangala Capital Investment Management, a licensed Namibian Asset Management Company, offers unit trusts as well as segregated solutions. Hangala Capital Investment Management is owned by Hangala Capital 36%, Nineteen Nil Four Holdings 19%, Trophy Shapange 10%, and Aluwani 35%.

Hangala Capital also has a technical agreement with Aluwani for providing portfolio and administration management services. Aluwani Capital Partners is an independent owner-managed investment management business, registered with the Financial Services Conduct Authority (FSCA) and is an approved investment manager in terms of the Financial Advisory and Intermediary Services Act (FAIS).

For More information visit: https://www.hangalacapital.com